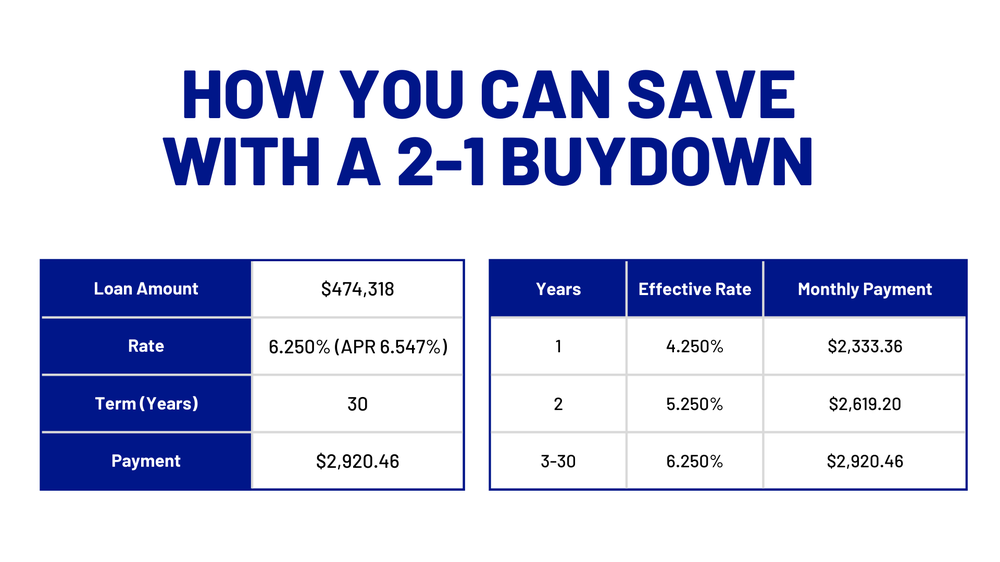

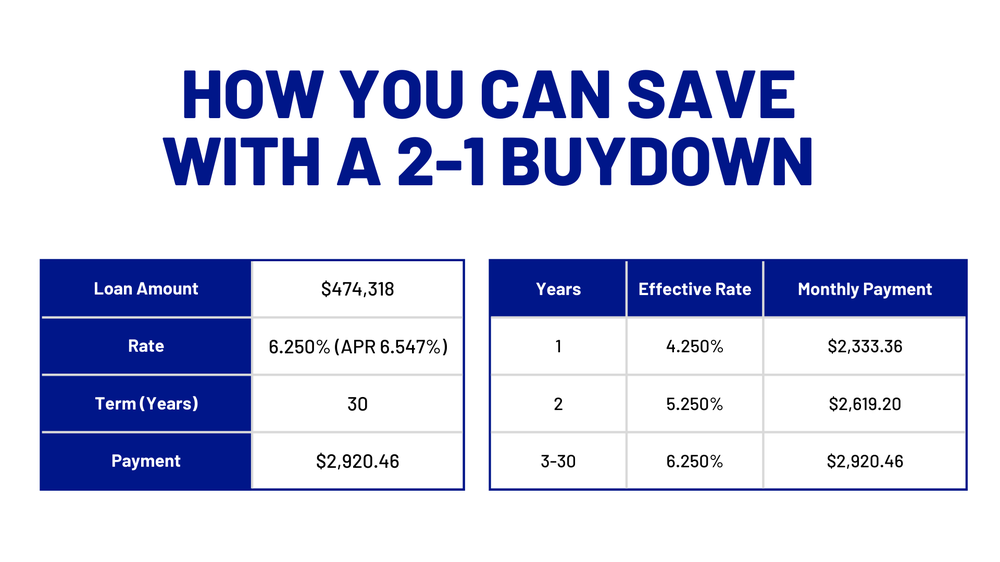

Own a brand new move-in ready home with a lower interest rate! You could have an interest rate as low as 4.25%* (APR 6.547%)!

What is a 2-1 buydown loan?

What is a 2-1 buydown loan?A 2-1 buydown loan provides buyers a lower mortgage payment during the first two years of the loan. During the first year, the interest rate will be 2% lower than the note rate. The second year, the interest rate will be 1% lower than the note rate. Then, at the third year, the interest rate will move to the original note rate.

*The sample rates provided are for illustration purposes only and are not intended to provide mortgage or other financial advice specific to the circumstances of any individual and should not be relied upon in that regard. De Young Mortgage, cannot predict where rates will be in the future. The advertised loan program is a Temporary 2-1 Rate Buy-Down with a 30 year fully amortizing term. It provides an interest rate 2% below your note rate in year 1, and 1% below your note rate in year 2. In year 3, the loan will move to the note rate.

The advertised example is for a locked interest rate of 6.25%, Annual Percentage Rate (APR) 6.547%, the interest rate will be 4.25% for the first year (months 1-12). For the duration of year 2 (months 13-24), the interest rate will be 5.25%. In years 3-30 (the remainder of the loan), the interest rate will be fixed at 6.25%. The interest rate quoted assumes a $527,020 purchase price, 90% loan-to-value (LTV), and a minimum FICO score of 740 on a primary residence. The 2-1 Temporary Rate Buydown program applies to VA, FHA and conventional loans. It does not apply to jumbo loans or other loan programs. On a $474,318 loan, the monthly principal and interest payment would be $2,920 for years 3-30. Rates effective as of 10/10/2022.

The payment example does not include assessments. Actual payment obligations may be greater and may vary. Mortgage Insurance Premium (MIP) is required for all FHA loans and Private Mortgage Insurance (PMI) is required for all conventional loans where the LTV is greater than 80%. Rate(s), APR(s) and payment info is valid as of 10/03/2022 and assumes a first lien position, 740 FICO score, 30 day rate lock, based on a single-family home. All terms are subject to change without notice. Loans are subject to underwriting guidelines and the applicant’s credit profiles, not all applicants will receive approval. Contact De Young Mortgage, for more information. Available for conventional, FHA, VA, and loans only.

2-1 Buydown financing incentive is only available when financing through De Young Mortgage. 2-1 Buydown financing incentive cannot be combined with any other financing incentives or specials.

6262 E Saginaw Way, Fresno CA

Are you looking for a spacious home that's perfect for entertaining? Have you been looking for a single story, open floorplan concept?

Then the Icon Series Residence 190 could be right for you!

- 1,904 Sq. Ft.

- 3 Beds

- 2 Baths

- 3 Car Garage

- Large kitchen island opening to the dining and great room

- Gourmet kitchen with oversized food pantry

- Sizeable owner suite with extra-large walk-in closet

To learn more and schedule your tour of this brand new home, click

here.

The Right Financing For YouDe Young Properties is pleased to recommend the competitive lending advantage of our affiliate,

De Young Mortgage. De Young Mortgage offers the smartest financing programs and one-stop financing to make the home-buying process simple and satisfying.

To learn more about financing your dream home, click

here.